tax per mile rate

These new rates become effective July 1 2022. So for the 2022 tax year you are able to write off 0585 for every mile you drive up from 056 in 2021.

2021 Mileage Reimbursement Calculator

Since January 1 2018 moving expenses are only deductible and therefore eligible for tax-free reimbursement for active-duty military members due to the change in the law made by the Tax Cuts and Jobs Act of 2017 TCJA.

. Overall average van rates vary from 230 286 per mile. Charitable organizations remain the same as it is set by statue at 14 cents per mile rate. What is a mileage tax.

Multiply your Oregon taxable miles times the rate to. The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. For the final six months of 2022 the standard mileage rate for business travel will be 625 cents per mile an increase of four cents from the rate effective at the start of the year.

As of July 2021 trucking rates per mile remain steady. The vehicle mileage tax is typically based on how many miles you drive in a particular time frame like a year or. Also we stroll the Neighborhood for some Ice Cream.

The standard mileage rate writes off a certain amount for every mile you drive for business purposes. The IRS doesnt narrowly. Ad Compare Your 2022 Tax Bracket vs.

Standard Optional Mileage Rates for 2022. Business Charity Medical Moving. 2 days agoFor the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

Use these rates only when operating at declared weights of 80000 pounds or less. This increase to 625 cents will be effective on July 1 and remain for the rest of this year. The IRS announced Thursday that for the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate the IRS set at the start of the.

NATIONAL WCIA The Internal Revenue Service announced on Thursday to raise the mileage rate used to calculate business tax deductions by four cents per mile. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of. The rate for deductible medical or moving expenses will likewise increase from 18 to 22 cents per mile.

2 days agoFor the second half of 2022 the standard mileage rate for business use of an automobile will increase from 585 to 625 per mile. The rate adjustment in 2011 was 45 cents per mile from 51 to 555 cents per mile. The standard mileage rate.

Effective July 1 through Dec. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as a road user charge. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. INSTRUCTIONS FOR TABLE A.

Medical and moving expenses driving is 18 cents per mile. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. The business standard mileage rate is used to compute the deductible costs of operating an automobile for business use on behalf of tracking actual costs.

2 days agoThe optional standard mileage rate for business-related driving is increasing to 625 cents per mile starting in July. If an employee drives a car while on the job that gets 25 miles per gallon MPG the rate increase translates. Mileage rates are generally set once a year.

Lets chat about the New IRS mileage Rate that has been Increased to 625 cents per mile. Reefer rates are averaging 319 per mile with the lowest rates being the Northeast at 247 per mile. Average flatbed rates average at 314 per mile.

The Internal Revenue Service is making a rare midyear decision to set a new higher mileage reimbursement rate in light of increasing gas prices. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Every vehicle-related expense you incur is rolled into that deductionso you cant use the standard.

The standard mileage rate is the default cost per mile to drive established by the Internal Revenue Service IRS for taxpayers who claim a tax deduction on an IRS form for the cost of using a vehicle for business expenses charitable or medical purposes and even moving expenses. 2 days agoJun 9th 2022. Jun 10 2022 0500 PM CDT.

1 day agoStarting in July the optional standard mileage rate for business-related driving is increasing from 585 cents per mile to 625 cents. Your 2021 Tax Bracket to See Whats Been Adjusted. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for.

Bet on you Set. RATES EFFECTIVE JANUARY 1 2022. Individual Tax Return Form 1040 Instructions.

Lets start with freelancers and other self-employed individuals who use Form 1040s Schedule C to claim cpm short for cents-per-mile deductions for business driving. A four-cent rise will also happen to vehicles used. Use Table B rates for.

Here are the current rates for the most popular freight truck types. Instructions for Form 1040. 202022s cpmrate is 585 up from.

There are apps that. The rates for deductible medical travel and moving expenses. Deducting 4 more than in 2021 56 cents to 585 means that.

Rates in cents per mile Source. Discover Helpful Information and Resources on Taxes From AARP. The standard rate for medical and moving purposes is based on the variable costs as determined by the same study.

For travel rates from January 1 to June 30 2022 taxpayers should use the rates in Notice 2022-03. Mileage tax is a type of tax that is paid by the driver based on miles driven. 2 days agoThe new rate for the final six months of 2022 will be 625 cents a mile up from 585 cents a mile which itself was a 25 cent increase from 2021.

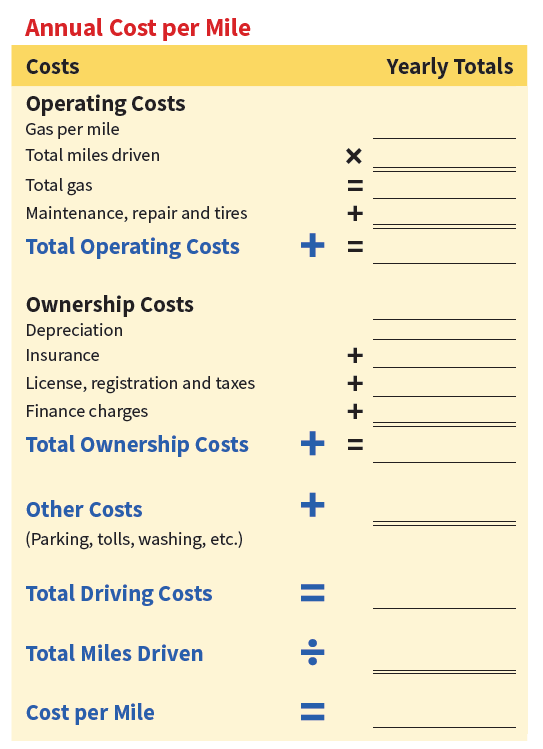

And charitable driving is 14 cents. The mill rate to dollars per mile see examples below the chart. The table below shows the IRS optional standard mileage rate rates for the first and second half of calendar year.

For 2022 the business mileage rate is 585 cents per mile. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate. 31 2022 the standard mileage rate for the business use of employees vehicles will be 625 cents per milethe highest rate the IRS has ever publishedup 4 cents.

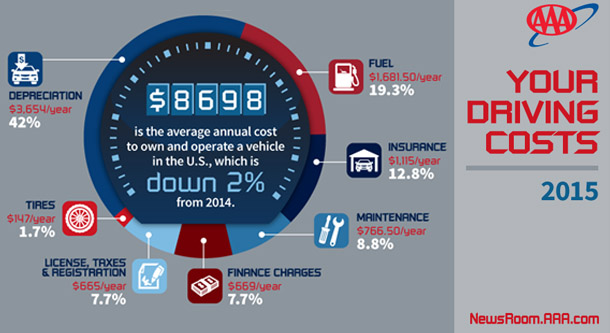

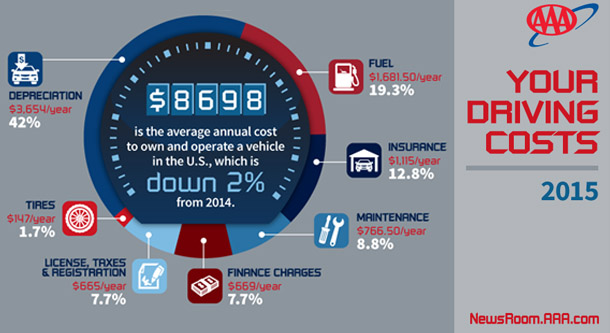

Aaa S Your Driving Costs Aaa Exchange

What Is Per Diem Definition Types Of Expenses More

The Irs Mileage Rate For 2020 See How Much You Can Get Per Mile

What Are The Mileage Deduction Rules H R Block

Irs Raises Standard Mileage Rate For 2022

Motor Fuel Taxes Urban Institute

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Infrastructure Package Includes Vehicle Mileage Tax Program

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Aaa S Your Driving Costs Aaa Exchange

How Do State And Local Sales Taxes Work Tax Policy Center

Irs Publishes 2022 Standard Mileage Rates Grant Thornton

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Annual Cost To Own And Operate A Vehicle Falls To 8 698 Finds Aaa 2015 Your Driving Costs Aaa Newsroom

Aaa S Your Driving Costs Aaa Exchange

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos